- CONTENTS

- PREFACE

-

1.Transformation and Upgrading Trends in the Financial Industry

-

2.Introduction to Sm@rtOneBank Integrated Banking Solution

-

3.Practice of Sm@rtOneBank Integrated Banking Solution

-

4.Looking Forward to Exploring Together

Through research and project experiences with banks in regions such as Southeast Asia, the Middle East, and Central Asia, we have found that developing countries and regions suffer from inadequate formal financial services and outdated infrastructure, resulting in a significant population with no or inadequate bank accounts. Among the 400 million adults in Southeast Asia, only around 25% have accessed financial services such as bank accounts, credit cards, investments, and insurance. Therefore, banking institutions need to rapidly expand their client reach through digital technology, as the potential of the digital financial market is immense.

Stable social and economic growth has fueled rapid development in local financial and fintech services. Regulatory agencies in these regions have successively introduced innovative regulatory approaches and financial licenses, lowering the barriers to financial entry. At the same time, they have highly recognized technologies such as digital currencies, AI, and cloud computing. The emergence of numerous new institutions has also generated clear demand for fintech services.

For all overseas banks, particularly those in developing countries, the next decade will see a comprehensive upgrade of their core banking systems. Additionally, some domestic capital will venture into the overseas financial industry to establish new banks. These two types of banks have weak technological foundations in fintech and focus on comprehensive system coverage of business needs, adoption of new technologies, and IT system support for the internet and scenario-based finance. They generally prefer vendors to provide holistic solutions.

"Each is beautiful in its own way, and the beauty of one enriches the beauty of all." China's financial industry practices and experiences provide valuable insights and references for the digital transformation of global financial institutions. As a fintech enterprise deeply rooted in China's financial industry, DCITS, with a profound understanding of China's financial industry's architectural transformation, has developed the "Sm@rtOneBank Holistic Solution" for international banks. We are eager to share China's experiences with international peers and the financial industry, making finance more technological and intelligent.

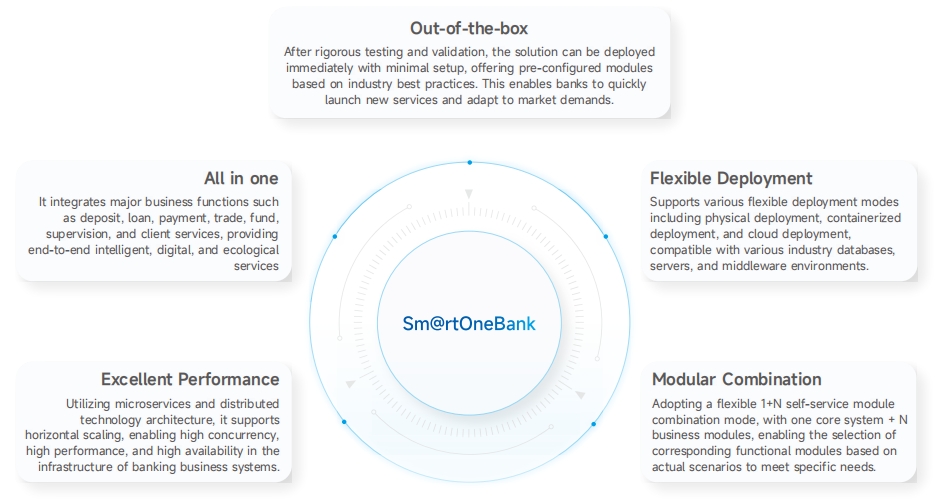

Design Objective of Sm@rtOneBank